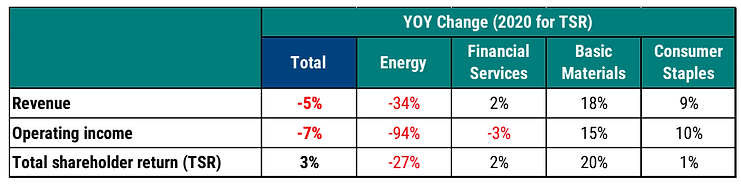

In 2020, we witnessed a year of significant volatility and change because of the COVID-19 pandemic and its related economic impact. The TSX Composite Index dropped by 34% within a month but recovered by the end of the year. There were significant impacts on various stakeholders, including customers and employees, which accelerated discussions on the role of the corporation in considering broader stakeholder interests. It was also a year over differing outcomes by industry. As illustrated in Table 1 for the S&P/TSX 60, while overall performance and the financial services sector were slightly negative/flat, the basic materials and consumer staples sectors had relatively strong years while the energy sector was significantly impacted by lower commodity prices.

Table 1: 2020 Performance Summary

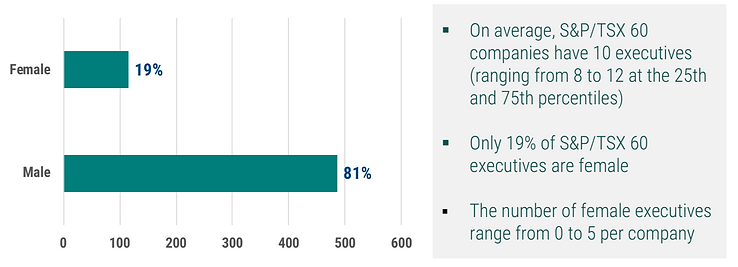

Executive Demographics

To provide additional context on the executive compensation trends, we extracted data on the executive teams among the constituents of the S&P/TSX 60 as summarized in Chart 1. We identified a total of 601 executives, of which, 115 or 19% are female.

Chart 1: 2020 Executive Demographics

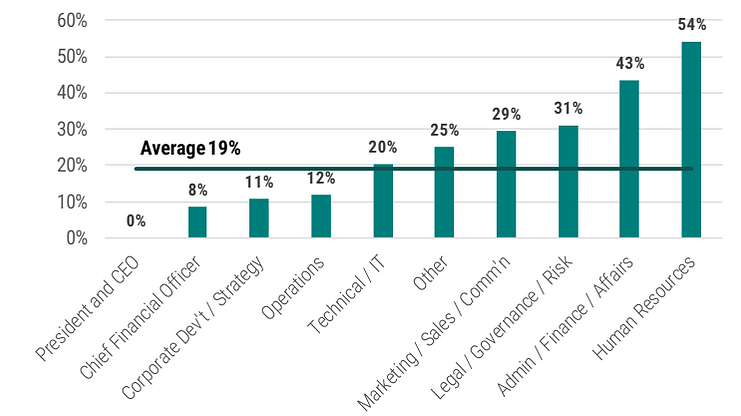

As summarized in Chart 2: gender distribution varies quite significantly by role. With less than average representation among CEOs, CFOs, Corporate Development and Operational roles and more than average representation among Marketing, Legal, Administration and Human Resources roles.

Chart 2: 2020 Gender Distribution by Role

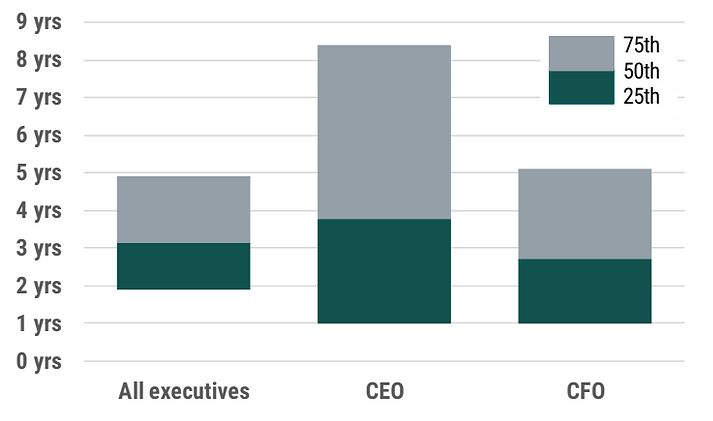

In Chart 3, we summarize tenure in role which is approximately three years at the 50th percentile and is slightly higher at approximately four years for CEOs. There is greater variability of tenure among CEOs ranging from one to eight years (25th to 75th percentiles) relative to CFOs ranging from 1 to 5 years (25th to 75th percentiles). Average tenure also varies by gender with an average of 3.4 years for male executives and 1.9 years for female executives.

Key Implications

- Tenure can have an impact on compensation as newer executives tend to be paid less than fully experienced executives

- Gender pay differences might be exaggerated in roles with material differences in gender representation relative to average. For example, Human Resource roles might have lower market compensation levels relative to Operational roles due to gender rather than differences in the internal comparability of the roles. Market data needs to be carefully interpreted to not perpetuate potential gender bias

- From a talent perspective, organizations need to consider how to rotate female executives across the organization, including technical and operational roles, to support their progression to CEO where a lack of female representation continues to exist

Market Compensation Trends

The following compensation trends are based on the same incumbent in both 2019 and 2020 and represent actual compensation disclosed in 2019 and 2020, including actual salaries, actual bonuses and long-term incentive grants (all reported in CAD).

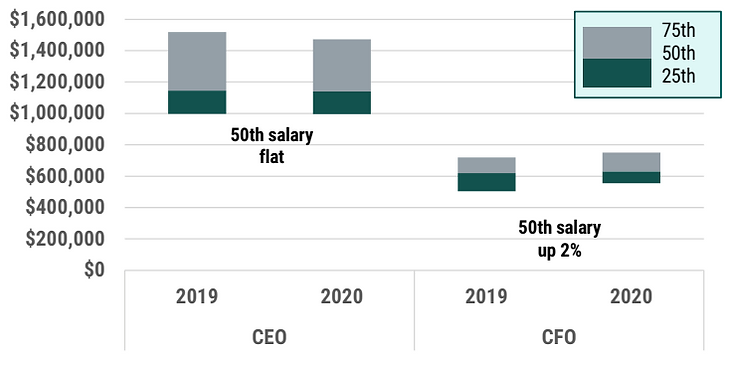

Chart 4: 2019 and 2020 Salaries

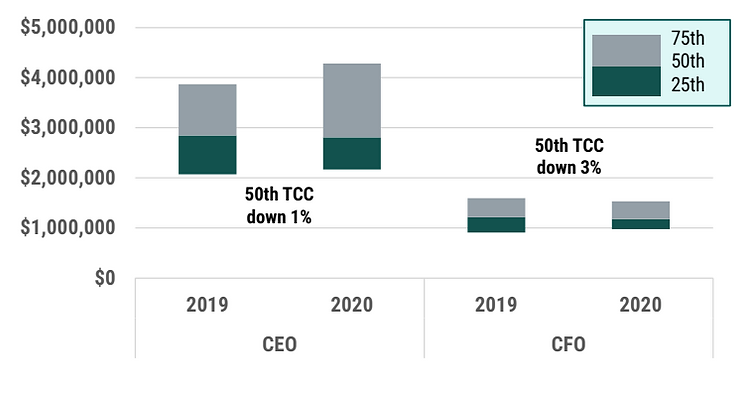

Chart 5: 2019 and 2020 Total Cash Compensation

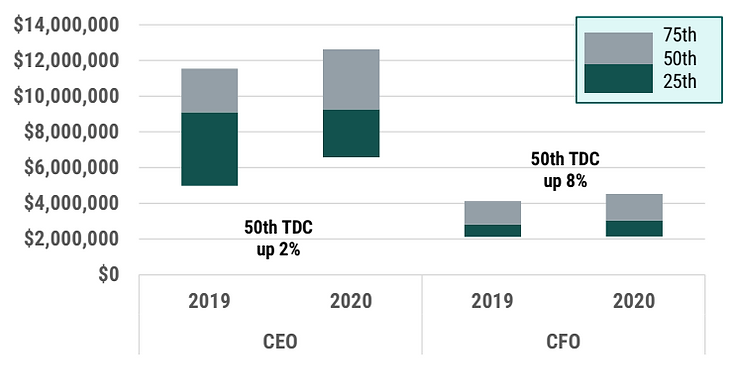

Chart 6: 2019 and 2020 Total Direct Compensation

Key Takeaways

- Salaries were relatively flat between 2019 and 2020 with little variability across the sample

- Actual bonuses for 2020 performance were slightly lower than actual bonuses for 2019 performance resulting in a slight decrease in total cash compensation. However, there was a wider range of bonus outcomes in 2020 as illustrated by the increase at the 75th percentile

- Total direct compensation increased in 2020 as a result of higher long-term incentive awards that were generally granted in early 2020, before the pandemic

- We observe a relationship between company size – in terms of market capitalization – and CEO total direct compensation; an important consideration when interpreting these findings

- As we look forward, we anticipate that 2021 compensation will increase from 2020 because of strong share price performance, higher bonuses and higher 2021 long-term incentive awards

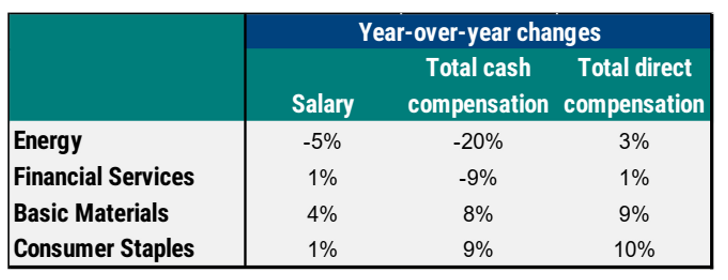

As illustrated in Table 2, year-over-year changes in compensation tend to be well aligned with broader industry dynamics. Energy companies had a relatively weaker year as exhibited by a 2% decrease in total cash compensation while basic material and consumer staples companies saw strong financial performance as exhibited by an 8% and 9% increase in total cash compensation, respectively.

Table 2: Year-Over-Year Changes in Average Pay

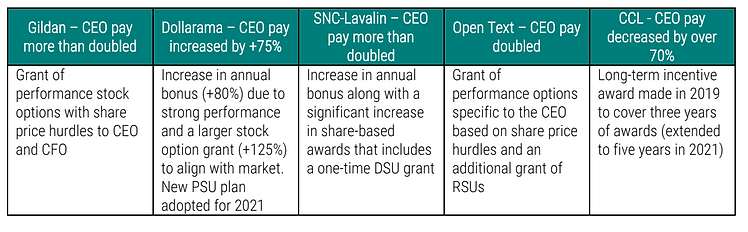

As illustrated in Table 3, there were several large year-over-year changes among CEOs including:

Table 3: Significant Year-Over-Year Changes in CEO Pay

In terms of overall pay mix, Chart 7 summarizes pay mix for CEOs and CFOs which continue to put a majority weighting on long-term incentives (LTI) with short-term incentives (STI) at approximately 1.5x salary for CEOs and 1.0x for CFOs.

Chart 7: CEO and CFO Pay Mix

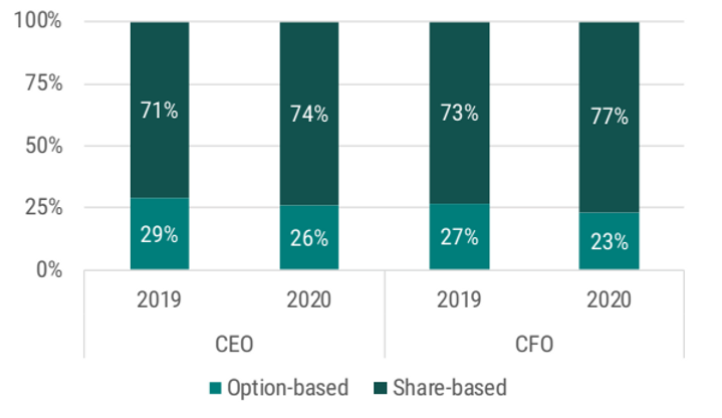

Chart 8 summarizes the average mix of long-term incentives granted to CEOs and CFOs in 2019 and 2020. We saw fewer companies grant stock options in 2020, and of those that made grants, a lower value was granted on a year-over-year basis, continuing a long-term trend to move away from options into other share-based awards, such as performance share units or restricted share units.

Chart 8: Average CEO and CFO LTI Mix (% of LTI)

Pay-for-performance

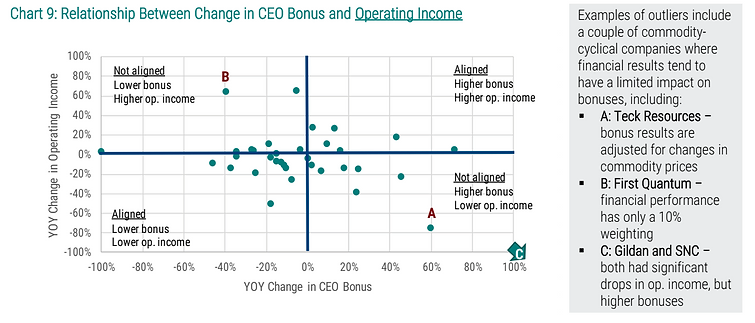

Chart 9 compares the year-over-year change in operating income with the year-over-year change in the CEO annual bonus (outliers greater than +/-100% were excluded). There does not appear to be much of a correlation between the two with no clear link between operating income and CEO bonus.

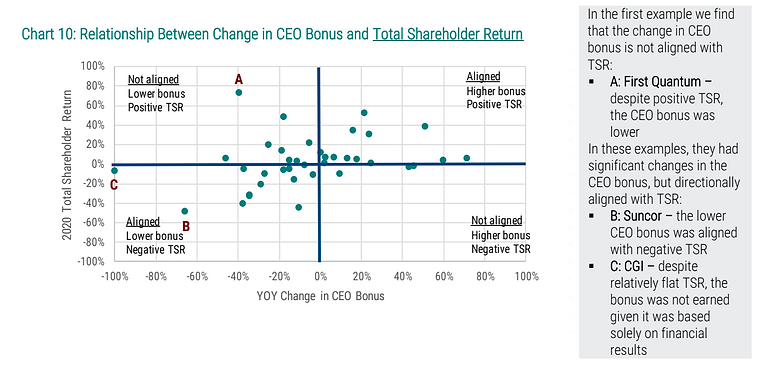

Chart 10 compares 2020 TSR with the year-over-year change in the CEO bonus.There does appear to be more of a correlation where positive/negative TSR appears to align with the relative change in CEO bonuses, likely reflecting judgement to align with the shareholder experience more closely.

Overall, it appears that most large Canadian companies demonstrated alignment between the shareholder experience and CEO compensation, and where results were not aligned, they tended to favour shareholders relative to the CEO. We recognize that this only captures a small portion of CEO compensation, and we would suggest an analytical review of the pay-for-performance relationship (e.g., reviewing realizable/realized compensation relative to performance on both an absolute and relative basis over a multi-year period). These analytics can be useful tools to test effectiveness for communication to plan participants and for disclosure to investors.

Interested in learning more about working with Southlea? Click here

Click to view our Service Offerings