Introduction

The treatment of executive compensation upon termination is often closely scrutinized given the circumstances of the departure and do not typically become an issue until they are triggered. This article summarizes market practices, examining how cash and equity compensation is treated under different termination scenarios, including the typical cash severance practices and equity termination treatment for Chief Executive Officers within S&P / TSX 60 Index companies1.

Cash severance payments are made when an executive’s employment relationship is ended under certain circumstances while the treatment of outstanding equity can vary depending on the termination scenario. The most common methods of termination, and the ones considered in this analysis are change in control, voluntary and involuntary termination, termination with and without cause, death, disability, and retirement. Some termination conditions are more lenient and provide favourable terms (e.g., death, disability, retirement) while others are more punitive (e.g., voluntary resignation, termination with cause).

Key Takeaways

- Virtually all companies have double trigger change-in-control provisions requiring both the change in control (CIC) and termination to occur

- Most CEOs receive 2 years of severance based on salary and target bonus, consistent with guidance from the proxy advisors, including ISS

- Equity treatment varies depending on the termination scenario. It tends to be more generous for death, disability and retirement and most punitive for termination with cause and resignation. Termination without cause is somewhere in the middle with the most variability in market practices

Change in Control

One of the most common termination scenarios involves a change in control of the executive’s organization. This change can arise from the change in the ownership of the company (e.g., acquisition of a minimum percentage of company shares, change in board members, sale of assets, etc.).

Severance provisions after a change in control are either single trigger or double trigger. A single trigger only requires the change in control to occur for the executive to be eligible for a severance payment. A double trigger, however, requires a qualified termination within a period following the change in control. As shown in Exhibit 1, double trigger events are the most common practice. The median window for the qualifying termination to occur after the change in control is 24 months.

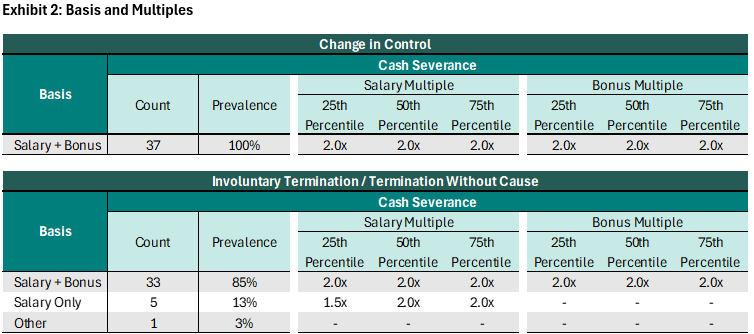

Cash Severance

Executives typically receive cash severance that is expressed as a multiple of their salary and bonus. As shown in Exhibit 2, CEOs often are entitled to 2 times their salary and bonus for a termination without cause, regardless of a change in control. The range in market practice is is narrow. For Chief Executive Officers, the lowest 25th percentile value is 1.5x and the highest 75th percentile value is 2.0x. The bonus is usually defined as “target” however many contracts also use a three-year average of actual bonuses.

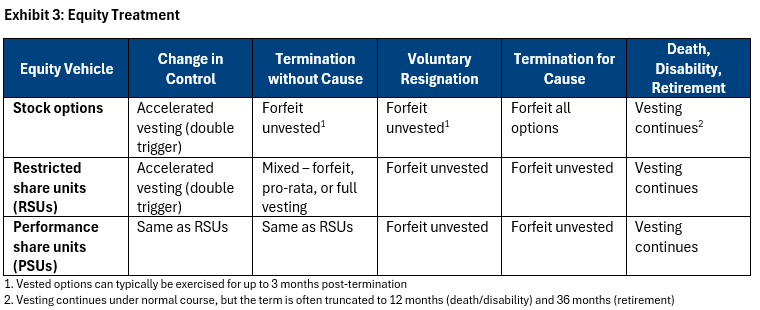

Equity Treatment

As shown in Exhibit 3 below, the treatment of outstanding equity varies based on the reason for the executive’s termination and tends to be more generous for death, disability and retirement relative to termination without cause. Ensuring sufficient differentiation between termination without cause (when cash severance is also provided) and retirement (when no severance is provided) helps to encourage retirement. Voluntarily resigning and being terminated for cause results in the most punitive treatment, which makes sense given the circumstances.

For performance share units, there is the added complexity of addressing the performance condition. When disclosed, it is most common for actual performance, followed by target performance, to be used to determine the value. Payouts are usually made upon termination following a change in control and death. In the other scenarios, payouts tend to occur at the end of the performance period and provided under normal course, consistent with regular plan participants.

Summary

It is important to regularly review plan documents and employment agreements to understand how compensation is treated under various termination scenarios. This can have material implications when employment relationships end at which point it is too late to make any changes. Common issues raised, include:

- Executives qualify for retirement treatment under the long-term incentive plan (LTIP), which means that there are no longer any meaningful retention hooks given that they can effectively retire and keep their outstanding LTIP

- The definition of performance within performance share units upon a termination. While it is simpler to use “target” to define the performance multiplier, proxy advisors (e.g., ISS) prefer that actual performance is used. This can raise some challenges in defining performance in the middle of the performance cycle depending on the measures within the plan

- Consistency in treatment across executives, where practical. In many cases, executives join over time and the standard contract can vary resulting in different treatment. It can be difficult to amend existing agreements but there are sometimes circumstances (e.g., promotions, compensation increases) that can be tied to updates to the agreement overall

About The Authors

Henry McMann, Senior Analyst

Henry is a Senior Analyst at Southlea Group.

Henry has experience working across various sectors including financial services, asset management and consumer services.

Henry holds a Bachelor of Arts, Honours Business Administration from the Ivey Business School at Western University.

Affiliations

Henry has passed the CFA Level I and II exams.