The most recent iteration of the Southlea Asset Management Compensation Survey (effective April 1, 2024) was released on July 31, 2024 and covers target, actual, and maximum compensation data for over 11,500 incumbents and 500 unique roles within 35 leading Canadian Pension funds, captive asset managers, and independent alternative investment firms.

Actual pay levels are down year over year while targets remain flat

We found minimal increases of ~2% at median in salary and target total direct compensation (TTDC1) relative to the last version of the survey effective October 1, 2023. This is a reflection of the cooling labour market as firms return to a steady state after the past several years which saw drastic changes in the industry due to COVID and stronger than expected asset growth and investment returns.

Given the more challenging market conditions in 2023, we observed that overall actual compensation was lower than previous iterations of the survey. This decrease was more pronounced for investment employees compared to corporate employees and for senior employees compared to junior employees.

Senior investment employees see greater decrease in actual pay

When looking at actual total direct compensation data from the large Canadian institutional investors year-over-year, actual pay levels for the investment functions decreased by ~6% at median while pay for corporate functions decreased by only ~0.5% at median. This illustrates the increased effect overall market conditions have on investor pay as these roles directly impact the performance and growth of these funds.

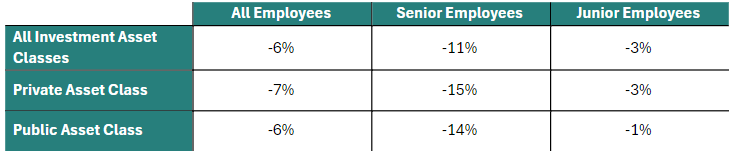

The table below shows how this decrease in median pay is greater for senior employees of the organization (executives to senior directors) compared to more junior employees (analysts to directors).

These figures align with our expectations that when performance is challenged, the pay of senior employees will be hit hardest as their actions impact overall performance more. Furthermore, these senior employees have more of their overall compensation delivered in longer-term incentives tied to fund / portfolio performance. This contrasts with more junior employees whose incentive compensation is typically more weighted towards annual performance, which consists of individual performance and some metrics related to company performance.

Private equity and real estate hit hardest by tough market conditions

When looking at specific private asset classes, private equity and real estate actual total direct compensation dropped more significantly compared to natural resources / infrastructure which is reflective of the challenging market conditions of 2023. Below are the year over year decreases in actual median pay for the senior employees of the following private asset classes:

- Private Equity: -28%

- Real Estate: -14%

- Natural Resources / Infrastructure: -3%

Looking forward

Challenging markets will impact organizations across the asset management industry, so while pay may be down at one fund, it will be down similarly at others. As the markets cool down after many tumultuous years of rapid changes and movements in the market, we expect pay levels reach a steady state where there will be modest increases in year over year target compensation and actual compensation will be reflective of wider market conditions of the time.

Given that a larger proportion of pay for senior employees is tied to longer-term performance, it is likely that the tougher market conditions of 2023 will continue to impact pay for the next couple of years. We will continue to monitor pay levels and how the asset management industry responds to continuously changing market conditions.

About Southlea’s Canadian Asset Management compensation survey

Released in July each year, Southlea’s Canadian Asset Management Compensation Survey is the most comprehensive in the market, and is the only survey to include all the following:

- Data from assistant to CEO in one survey, enabling consistent peer groups for all corporate disciplines and investor asset classes at each distinct survey level;

- Target, actual, and maximum incentive data (compared to other surveys which do not include target and/or maximum total compensation); and

- Carried interest dollars and work and carried interest allocation by role for independent alternative asset managers.

About The Authors

Tara Armstrong, Partner & Amanda Wildi, Consultant

Tara is a founder and Partner of Southlea Group. Prior to founding Southlea in 2021, she worked for 11 years at a large, global multi-service consulting firm, advising boards and senior management teams on effective executive and broad-based compensation program design and governance.

She helps clients align their pay programs with the organization’s purpose, values, and business strategy, and supports the selection and testing of performance measures that drive value and sustainable success. In her former organization, Tara was the Canadian lead of the North American Executive Compensation Transactions Team, and a member of the Due Diligence Centre of Excellence.

Amanda is a Consultant Southlea Group. She started her career at Willis Towers Watson in their Rewards practice providing project management and analytical support to clients at both the senior management and board levels to address a variety of executive compensation, workforce compensation, and broader human resource priorities.

Amanda has worked with publicly-traded, privately-held, and subsidiary organizations across a broad range of industries including financial services, energy services & utilities, and consumer goods. Prior to joining Southlea Group, Amanda worked at ZS Associates and Forma AI. Amanda has a Bachelors of Commerce with a Specialist in Finance and Economics from the University of Toronto.