S&P TSX Composite Index

Executive Summary

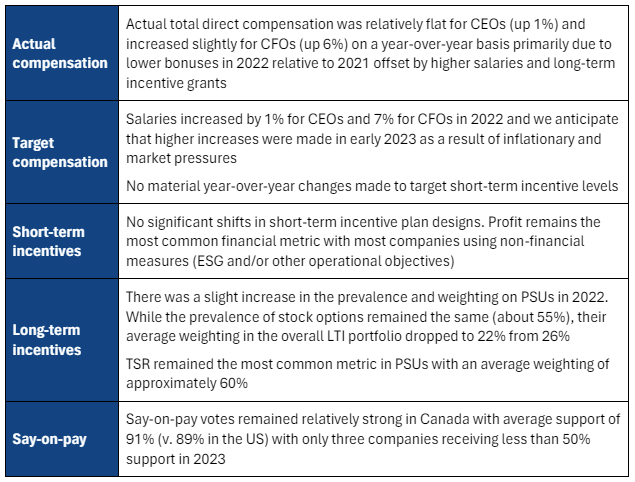

Market Trends

Other Emerging Trends

ESG and incentives – increasing tensions and trade-offs as companies consider whether to include ESG measures within their incentives, and a continued movement to more quantitative and measurable objectives for companies that have already adopted ESG measures

Pay longevity – as companies continue to move away from stock options, we see a shortening in the time period required to fully realize compensation (salary plus annual incentives plus long-term incentives). Focusing on the S&P/TSX 60 companies, the average CEO requires 2.4 years to fully realize their compensation which may not align with the investment and strategic time horizons for many businesses.

Introduction

This report summarizes year-over-year executive compensation trends among the companies within the S&P/TSX Composite Index. The data are from 218 companies that disclosed compensation for their executives and were collected by ESGAUGE, a data analytics firm.

Performance Context

In 2022, we saw a more challenging performance year with lower growth in operating income and challenging total shareholder returns (TSR). We continue to see significant differences by industry, with Energy outpacing the other sectors (refer to Table 1). As we reflect on 2023 to date, we anticipate more challenging performance conditions, given higher inflation and interest rates, lower growth expectations and overall geopolitical uncertainty leading to lower financial outcomes on a year-over-year basis. TSRs through 2023 are tracking negatively overall but with variation by industry ranging from minus 14% for Utilities to plus 10% for Information Technology. This can potentially create significant differences in pay outcomes across the broader market and would suggest that 2023 actual pay will track similarly to 2022 levels given flat performance.

Table 1: Performance Summary

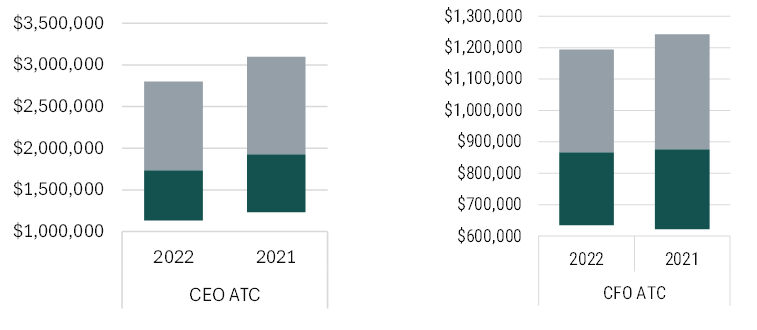

Market Compensation Trends

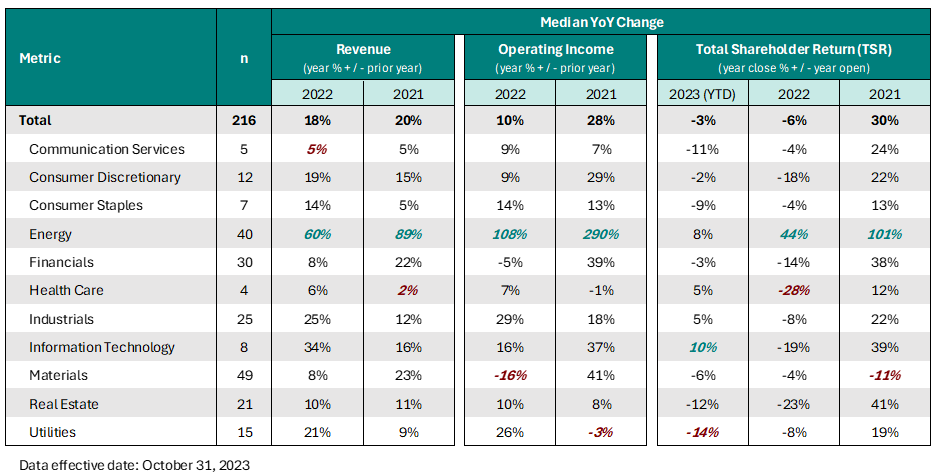

The following compensation trends are based on the same incumbent through 2021 and 2022, and reflect actual compensation disclosed in 2022 and 2023 proxy circulars, including actual salaries, actual/target bonuses and long-term incentive grants (on an as-reported currency basis, as disclosed).

Table 2: Year-Over-Year Changes in 50th Percentile Pay

Both actual and target total direct compensation levels, where disclosed, were relatively flat on a year-over-year basis. Last year, we found a 20% increase in actual total direct compensation because of significantly higher bonus payouts relative to a challenging 2020.

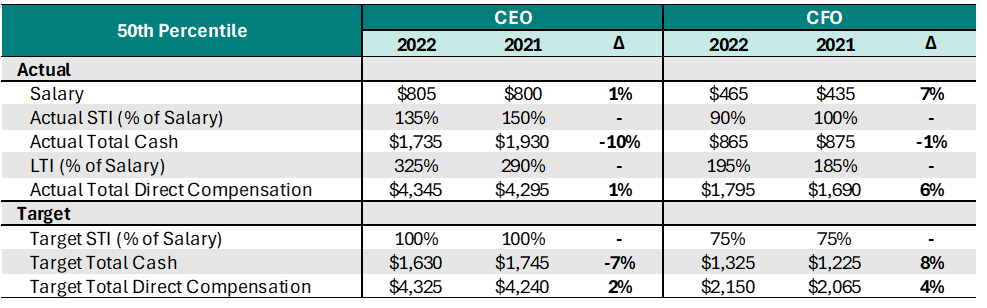

Chart 1: 2021 and 2022 Salaries

The median CEO salary in 2022 increased by 1% to $805,000. The median CFO salary increased by 7% to $465,000. Last year, we saw salaries for CEOs and CFOs increase by 12% and 7%, respectively.

Chart 2: 2021 and Actual Total Cash

Median actual total cash (ATC) decreased by 10% for CEOs and 1% for CFOs in 2022. The median actual bonus as a percentage of target bonus for CEOs decreased to 1.17x target in 2022 from 1.61x target in 2021. Last year, ATC increased by 34% for CEOs and 17% for CFOs.

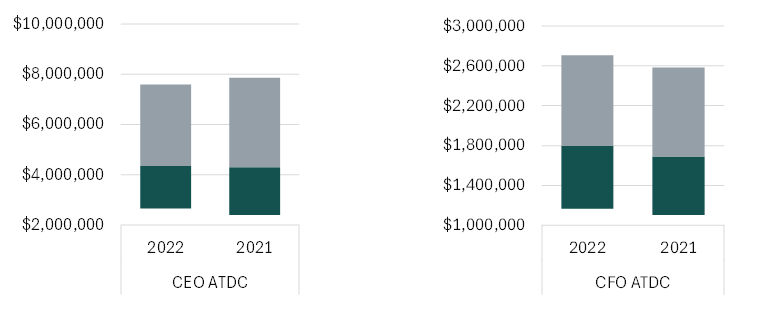

Chart 3: 2021 and Actual Total Direct Compensation

Median actual total direct compensation (ATDC) increased by 1% for CEOs and 6% for CFOs in 2022, primarily driven by higher salaries and long-term incentive grants. The median grant value of long-term incentives increased to 325% of salary from 290% for CEOs and 195% of salary from 180% for CFOs.

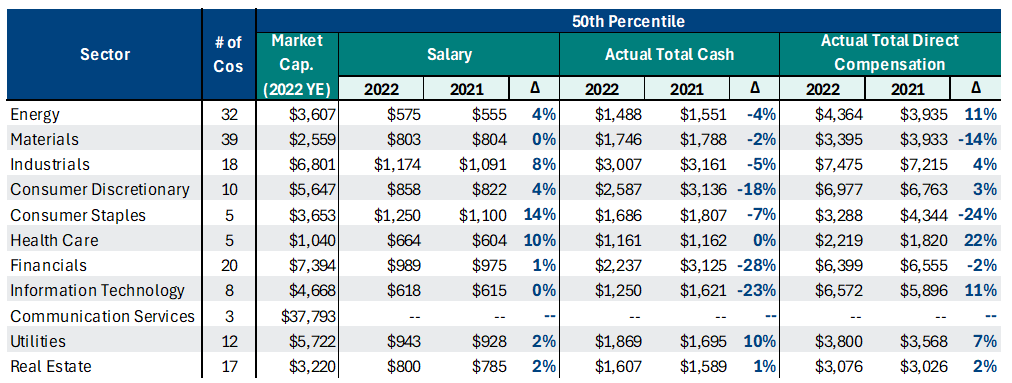

Table 3: CEO Compensation by Sector

We found significant variability in the quantum of CEO pay – likely driven by differences in the size of company in each sector – and also in the year-over-year change in CEO pay. The Energy sector saw a 11% increase in ATDC while the Materials sector saw a 14% decrease, commensurate with the performance of each sector (Energy sector TSR was up 44% while Materials sector TSR was down 5%). Note that some of the sectors have relatively small sample sizes (i.e., less than 10) and are subject to more volatility.

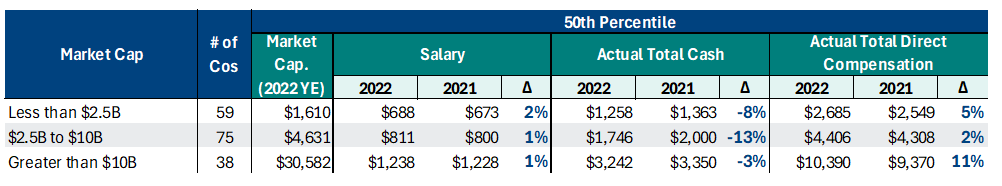

Table 4: CEO Compensation by Company Size

There are significant differences in pay based on company size. CEO salaries were flat across each of the size categories while ATDC saw the most significant increase among the largest companies in the TSX Composite (up 11% v. 1% overall)

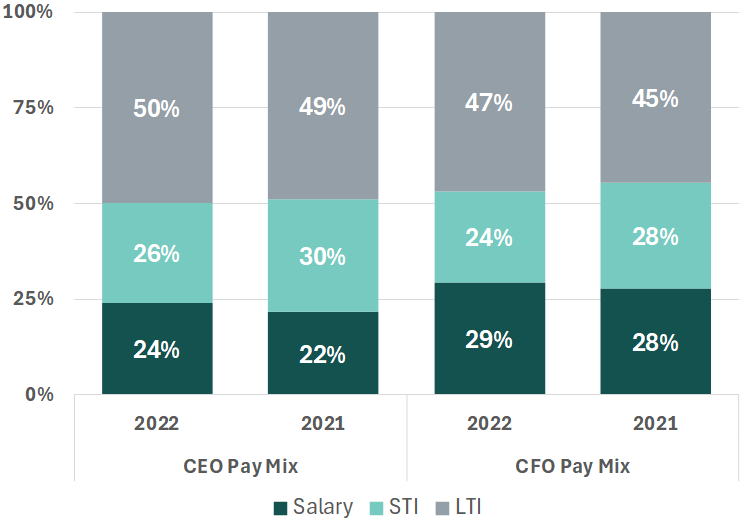

Pay Mix

In terms of overall pay mix, salary (or fixed pay) represented 24% of ATDC for CEOs and 29% for CFOs.

Actual short-term incentives (STI) represented approximately 1.1x salary for CEOs and 0.8x salary for CFOs and comprised a lower proportion of total pay relative to 2021 due to lower bonuses paid in 2022.

Companies continued to put a majority weighting on long-term incentives (LTI). This captures the value of the LTI at grant, but the actual value realized can vary significantly, reinforcing the importance of ensuring this portion of compensation is designed appropriately and aligned with strategy / shareholder interests.

Chart 4: CEO and CFO Pay Mix

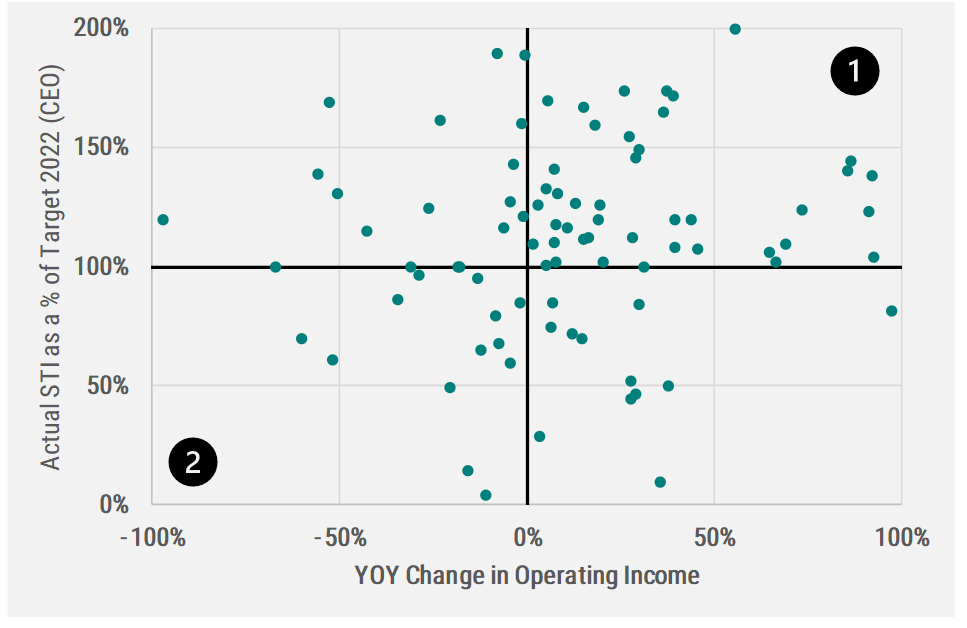

Pay-For-Performance

From a pay-for-performance perspective, we compared the year-over-year change in operating income relative to the actual short-term incentive paid (as a percentage of target). The majority of companies appear to be aligned in either the top right (1) or bottom left (2) quadrants.

- Top right (1) – most companies saw a YOY increase in operating income resulting in an above-target short-term incentive payment

- Bottom left (2) – some companies with a YOY decrease in operating income paid a bonus below 55%

We tend to find disconnects in industries that are more cyclical (mining/oil & gas) where financial performance is a smaller portion of the incentive award and/or not considered on a YOY growth perspective, suggesting more challenging disclosure of the pay-for-performance relationship.

Chart 5: Performance Analysis

Short Term Incentives (STI)

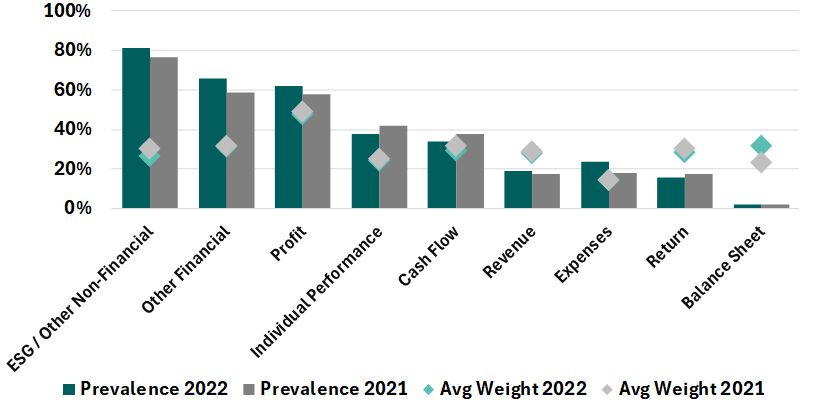

Within STI plans, organizations continue to place majority weight on financial measures, with an average weight of 70% (remaining 30% weight on non-financial measures).

Chart 6 summarizes the prevalence and mix of performance measures within the STI plan. ESG (and other non-financial) measures were the most common with an average weighting of approximately 30%. Profit-based measures at the most common financial weighting and remain the highest weighted type of measure at approximately 50% of the STIP. Individual performance is incorporated by about 40% of companies with an average weighting of ≈25%. Year-over-year changes remain minor on an overall basis with some shifting between measures.

Chart 6: Prevalence and Mix of STI Performance Measures

Long-Term Incentives (LTI)

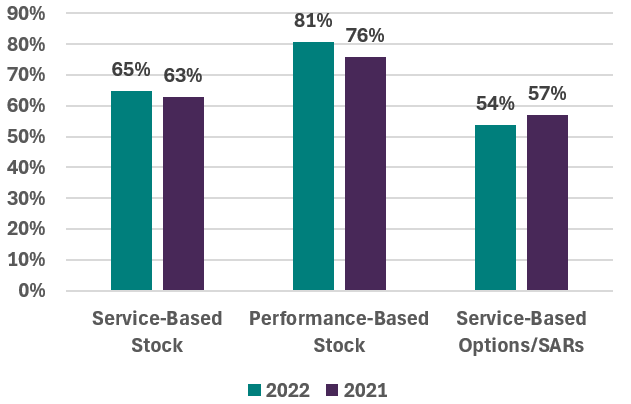

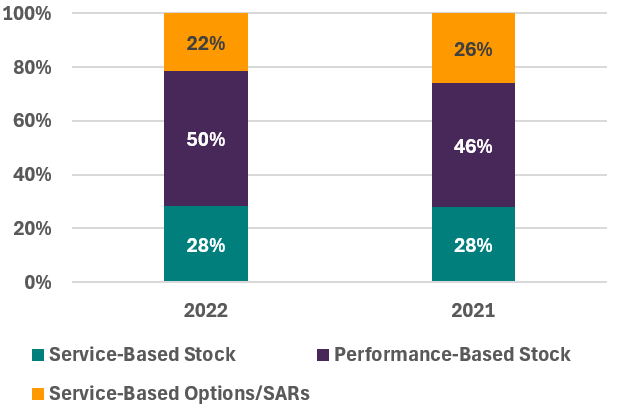

Chart 7 summarizes the prevalence of the long-term incentive vehicles granted to the CEO in 2022 and 2021 and Chart 8 summarizes the average mix of long-term incentives granted to CEOs over the same period. There was a slight increase in the prevalence and weighting on PSUs in 2022. While the prevalence of stock options remained the same (about 55%), their average weighting in the overall LTI portfolio dropped to 22% from 26%.

Chart 7: Average CEO LTI Prevalence

Chart 8: Average CEO LTI Mix (% OF LTI)

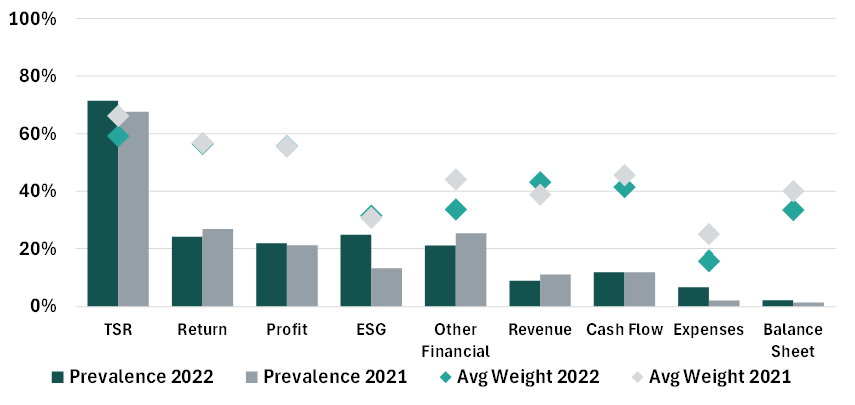

Chart 9 summarizes the prevalence and mix of performance measures in PSU plans. We saw some shifts in the types of measures used, but average weightings remained generally consistent. TSR remained the most common metric with an average weighting of approximately 60%. Given the increasing use of PSUs and relative TSR, there is more pressure on companies to get this component right, including participation, selection of the relative TSR comparison (market index or peer group) and the performance range calibration.

Chart 9: Prevalence and Mix of PSU Performance Measures

Say On Pay

Charts 10 & 11 summarize the say-on-pay results (as of October 27, 2023) for Canada (left) and the U.S. (right). In Canada, the average say-on-pay vote remains strong at 91% in 2023 (compared to 91% in 2022 and 2021). In the U.S., the average score has increased slightly to 89% from 87% and 88% in 2022 and 2021, respectively.

For most companies, there is little year-over-year change in the reported say-on-pay results and Table 5 highlights the most significant year-over-year increases and decreases. There were three failures in 2023 with Agnico Eagle and Open Text failing in both years.

Table 5: Significant Year-Over-Year Changes in Say-on-Pay Support

About This Author

Ryan Resch, Senior Partner

Ryan is a founder and Senior Partner of Southlea, a GECN Group company. He has over 20 years of experience consulting complex organizations across North America on executive and broad-based compensation including related governance considerations. He is often the named executive compensation consultant representing either the human resources committee and/or management. Prior to forming Southlea, he worked in Willis Towers Watson’s Toronto and Vancouver offices leading many of the practice’s large client relationships.

He leverages this expertise to bring stakeholders together and drive meaningful change aligned with key business and talent priorities. He is known for providing fresh and innovative thinking with his most recent research focused on connecting environmental, social and governance (ESG) with people and pay programs.