Executive summary

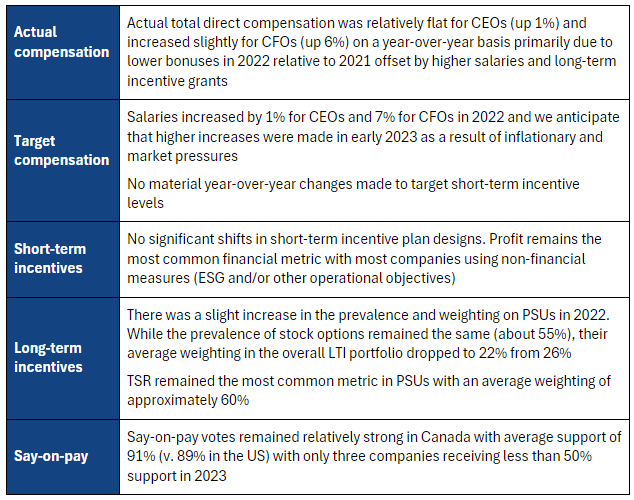

Market Trends

Other Emerging Trends

ESG and incentives – increasing tensions and trade-offs as companies consider whether to include ESG measures within their incentives, and a continued movement to more quantitative and measurable objectives for companies that have already adopted ESG measures

Pay longevity – as companies continue to move away from stock options, we see a shortening in the time period required to fully realize compensation (salary plus annual incentives plus long-term incentives). Focusing on the S&P/TSX 60 companies, the average CEO requires 2.4 years to fully realize their compensation which may not align with the investment and strategic time horizons for many businesses.

About This Author

Ryan Resch, Senior Partner

Ryan is a founder and Senior Partner of Southlea, a GECN Group company. He has over 20 years of experience consulting complex organizations across North America on executive and broad-based compensation including related governance considerations. He is often the named executive compensation consultant representing either the human resources committee and/or management. Prior to forming Southlea, he worked in Willis Towers Watson’s Toronto and Vancouver offices leading many of the practice’s large client relationships.

He leverages this expertise to bring stakeholders together and drive meaningful change aligned with key business and talent priorities. He is known for providing fresh and innovative thinking with his most recent research focused on connecting environmental, social and governance (ESG) with people and pay programs.