The Canadian federal government recently restricted the preferential tax treatment of stock options granted on or after July 1, 2021 (as enacted in the 2021 Budget Bill C-30). The following provides an overview of the changes, summarizes the potential impact, and highlights the key decision points for boards and senior management to consider. We believe that it will be important for companies to go through a strategic review of their long-term incentive (LTI) approach prior to making the next LTI grant, likely in early 2022.

OVERVIEW

The material changes are summarized as follows:

- Limit – preferential tax treatment is now limited to $200,000 per vesting year, per participant, determined at the time of grant (i.e., qualified options). It is important to note that the $200,000 is based on the total face value of the underlying shares (i.e., share price X number granted) and not the Black-Scholes fair value or compensation value of the options that is typically used to determine how many options are granted. For example, $200,000 of underlying share value could be based on a $20 grant date share price on options to buy 10,000 shares. These options would have a face value of $200,000. but an expected or compensation value of $40,000 (assuming a 20% Black-Scholes value) at the date of grant. In this example, all of these options could be designated as “qualified”

- Exceptions – companies that are Canadian Controlled Private Corporations (CCPC) or companies that have annual gross revenues less than $500 million are excluded from these new limits to recognize the importance of stock options in the attraction and retention of key talent in start-up companies

- Corporate tax – under prior rules, stock options (along with other treasury-settled share plans) were not deductible for corporate tax purposes. The new rules provide for a corporate tax deduction – for non-qualified stock options only – equal to the value of the ultimate stock option benefit realized upon exercise. Companies would need to decide if the options granted are qualified or not. If deemed to be qualified (for those options up to the $200,000 limit per participant), the employees will receive the preferential tax, and the company will forego the corporate tax deduction. All options granted that are deemed to be “nonqualified” would receive the full corporate tax deduction

IMPACT

There are three key areas of impact for stock option participants:

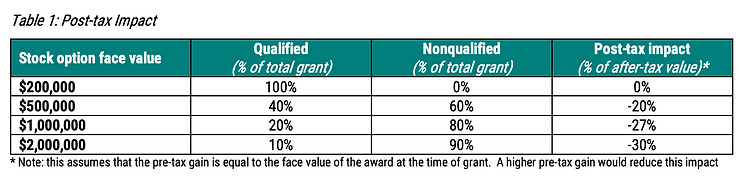

1. Post-tax realizable value – as illustrated in Table 1, the post-tax impact varies by the value of the stock option grants that would be deemed nonqualified (i.e., above the $200,000 limit) and no longer receive preferential tax treatment. As options are often only one vehicle in the LTI portfolio, the impact on the overall post-tax LTI award value is more moderate (e.g., if stock options made up only 25% of LTI granted, the post-tax impact shown below would be reduced commensurately, to less than -10%)

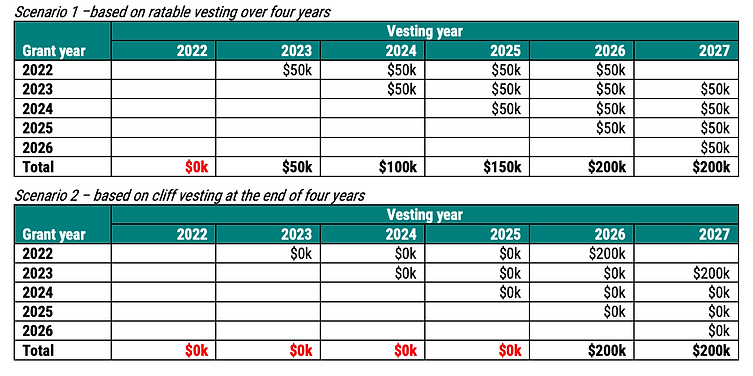

2. Vesting differences – given that the limit is based on $200,000 per vesting year and is determined at the time of grant, vesting practices can impact how many qualified v. non-qualified options could be granted within this limit. As shown in the following two tables, companies with ratable vesting (i.e., a portion vests per year), would have some qualified options vesting in each year, while companies with cliff vesting (i.e., 100% vests at the end of a defined period) would only see qualified options receiving preferential treatment in the year of vesting. In either case, the full $200,000 limit per year (which would start in 2022) may not be fully utilized depending on the vesting schedule which we discuss in the next section.

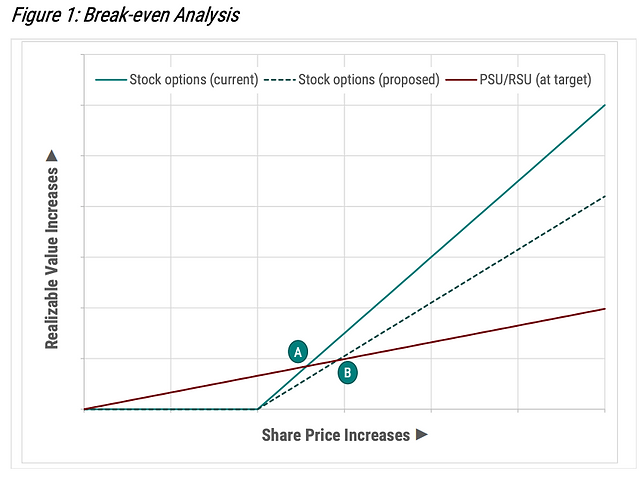

3. Shift of the break-even point – given the impact on the post-tax value of the options, a higher rate of share price growth is required to deliver the same post-tax value. In addition, when companies compare options to other LTI vehicles (i.e., performance or restricted share units), the break-even point in the post-tax realizable value increases, meaning a higher growth rate is required to deliver the same value through stock options as share units (as shown by the movement from A to B in Figure 1). What has not changed is the leverage profile of stock options relative to other share units – they continue to provide significant upside potential under strong share price growth scenarios.

DECISIONS

In working through these changes, we believe that there are three key decisions for boards and management to make starting with the annual LTI awards granted post July 1st, 2021. These are strategic decisions that will take time to review and finalize given the potential impact that they may have on the long-term incentive approach. While some companies may take a more passive “wait and see” approach, a proactive approach will allow organizations to optimize the annual $200,000 limit and mitigate uncertainty among plan participants. Now is the ideal time to develop an LTI strategy for the future.

1. LTI mix – while we recognize that individual tax considerations are not the primary driver of a company’s overall LTI design, we believe that this recent tax change could prompt Canadian companies to revisit their approach, given that the preferential treatment of options likely influenced the current prevalence and weighting. As an example, the prevalence and weight of options in the LTI portfolio tends to be higher in Canada relative to the U.S. (i.e., approximately 25-30% in large Canadian companies as compared to 15-20% in large U.S. companies), where options are generally taxed consistently with other LTI vehicles.

Considerations include:

- The organization’s go-forward business strategy and the mix between growth (more aligned with an option) and yield (more aligned with a full value share)

- Market trends and practices within the relevant talent pool, including the impact on different participants with varying levels of options that would no longer receive preferential tax treatment

- Balance between performance and retention (i.e., downside risk / upside leverage) under a variety of performance scenarios

- Mix of absolute and relative performance and/or the overall mix of performance measures given that options are implicitly based on absolute share price growth only

- Time frame associated with options (typically 7 or 10-year terms) v. share units (typically 3 year terms) and whether longer-term share units should be incorporated to maintain a long term orientation. As part of this decision point, access to equity-settled share plans will need to be considered, whereby full value shares can vest over longer time horizons beyond three years

A continuing role for stock options As part of a balanced LTI portfolio, complemented with PSUs / RSUs, we believe options can continue to be an effective tool for senior executives, regardless of the changes to tax as they provide:

- Strong growth orientation

- Alignment with absolute share price appreciation with no target setting required

- Long-term alignment Stock option designs may evolve to address potential concerns through longer-vesting, post-exercise hold periods and/or higher share ownership requirements.

2. Use of qualified options – options that do not provide participants with preferential tax (i.e., unqualified) will now give companies a corporate tax deduction that is equal to the value of the actual gain received at the time an employee exercises the option. Companies may decide that the value of the corporate tax deduction exceeds the value of the preferential tax provided to participants and/or the administrative complexity of managing qualified and non-qualified options is too great. In these circumstances, the company could decide to simplify the program to only grant non qualified options to all participants. They would need to consider whether this creates a competitive disadvantage in the attraction of key talent; however, we note that a similar tax structure is provided in the U.S. (i.e., through Incentive Stock Options) and most companies in the U.S. still tend to grant non-qualified options, as the administrative complexity and overall impact is typically not considered material.

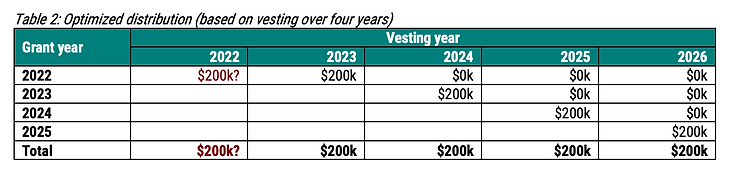

3. Option design – as noted above, the vesting schedule has a significant impact on how the $200,000 limit can be maximized each year. At the time of grant, companies can identify which options are qualified and unqualified. The following table illustrates how accelerated distribution of qualified options in early years of vesting can optimize the number of qualified options within the limit. This means that the vesting schedules for qualified v. non-qualified options will differ and may need to be adjusted depending on the total value of options that are granted. However, since most options start vesting one year after grant (e.g., February 2023 for a February 2022 grant), the $200,000 limit for 2022 will not be used (although options granted prior to July 1, 2021 continue to receive preferential tax treatment) and companies may wish to consider an alternate vesting schedule for the 2022 grant that allows a portion to vest prior to the end of 2022 (e.g., December 2022) while being aware of potential negative optics associated with vesting prior to the end of year one.

Interested in learning more about working with Southlea? Click here

Click to view our Service Offerings