One of Southlea’s predictions outlined in our 2025 Outlook for Human Resources Committees is the increasing pressure on executive pay levels, influenced by the weak CAD : USD exchange rate and the impact of U.S. compensation levels on large Canadian publicly traded companies.

As trusted advisors to Human Resources Committees (HRC) and management teams across Canada, we aim to address in this article how Canadian companies can attract and retain executive talent while competing against a U.S. market that pays higher on a dollar-for-dollar basis and with an increasingly weak Canadian currency. We provide a framework for determining the appropriateness of using U.S. peers in executive compensation comparator groups, reviewing North American pay levels at par or in converted dollars, and selecting the currency in which to calibrate and administer executive compensation. Our analysis reflects large Canadian (defined as: TSX60) and U.S. (defined as: S&P500) companies, leveraging market data collected by ESGAUGE.

Key Takeaways

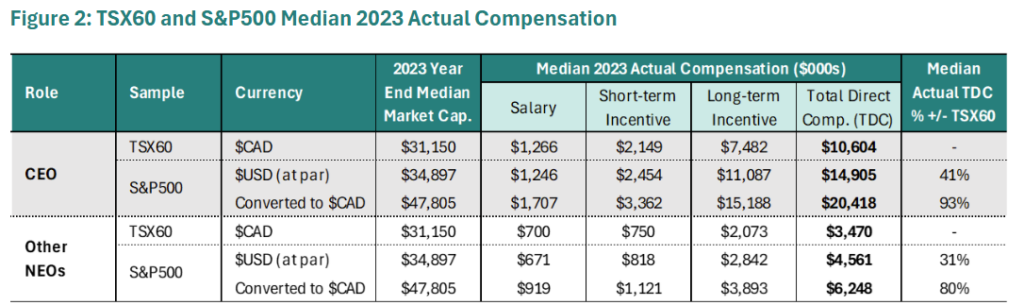

- Higher USD pay levels – The CAD : USD exchange rate is at a three-year low, amplifying differences in executive compensation levels in Canadian and U.S. talent markets. CEO compensation at U.S. companies is 40% higher than in large Canadian companies on an at par basis and over 90% higher when converted to CAD

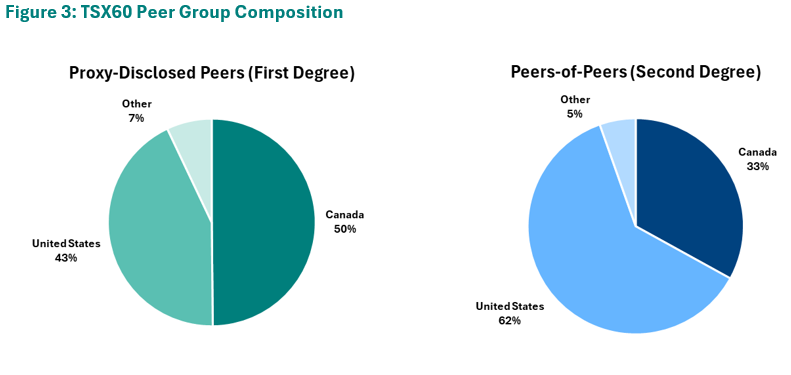

- Widespread use of U.S. companies in benchmarking – Almost 90% of TSX60 companies have North American peer groups for executive compensation benchmarking purposes, with average U.S. representation of 43%, directly influencing executive pay levels regardless of whether you include U.S. peers in your peer group. Representation of U.S. compensation within the comparator groups increases to 62% through indirect or second-level influence (peers of peers)

- Mixed practices on whether to convert U.S. pay into $CAD – In reviewing North American pay data, converting to a consistent currency is recommended when the market for talent is truly North American. Reviewing pay levels at par is recommended when U.S. data is included as a proxy a Canadian company, intended to create a sufficiently large sample of 12-15 peers

- Some Canadian companies deliver pay in $USD – Most TSX60 companies have a broad pay philosophy to set and disclose compensation in $CAD, though currency of compensation disclosure ($CAD v. $USD) is an influencing factor. Canadian companies calibrating and delivering pay in $USD should be mindful of proxy advisor methodologies to review pay-for-performance alignment in $CAD and the impact on disclosure if reported in $CAD

Context: Macroeconomic Environment And The U.S. Compensation Premium

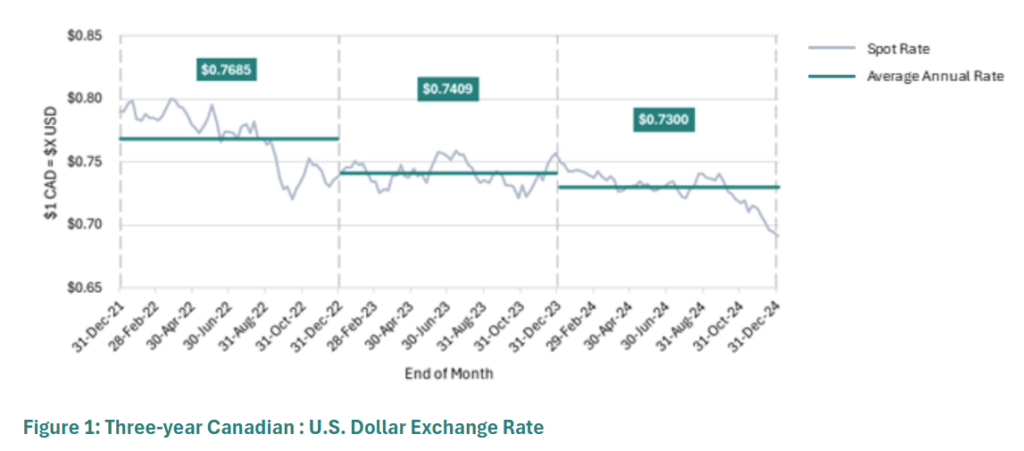

The Canadian dollar has been depreciating consistently against the U.S. dollar over the past three years, as shown in Figure 1. There was a sharp decline in the CAD : USD exchange rate at the end of 2024 due to the threat of U.S. tariffs on Canadian imports, a widening interest rate differential following Bank of Canada interest rate cuts, and leadership transitions in the Canadian government undermining investor confidence.

The continued depression of the exchange rate amplifies existing compensation differences between Canada and the U.S. Using our Interactive Executive Compensation Dashboard, Figure 2 summarizes 2023 median actual compensation among the TSX60 v. the S&P500. At par (i.e., $1USD = $1 CAD), U.S. CEO total direct compensation is 41% higher than observed in Canada, largely due to higher long-term incentive levels. The premium increases to 93% when data are converted to $CAD at the 2024 annual exchange rate of $1 CAD = $0.73 USD. There is a similar relationship for actual compensation among other Named Executive Officers (NEOs). As the pay gap between the countries widens, peer group decisions and the treatment of currency in executive compensation benchmarking have a greater impact.

Executive Compensation Currency Decision

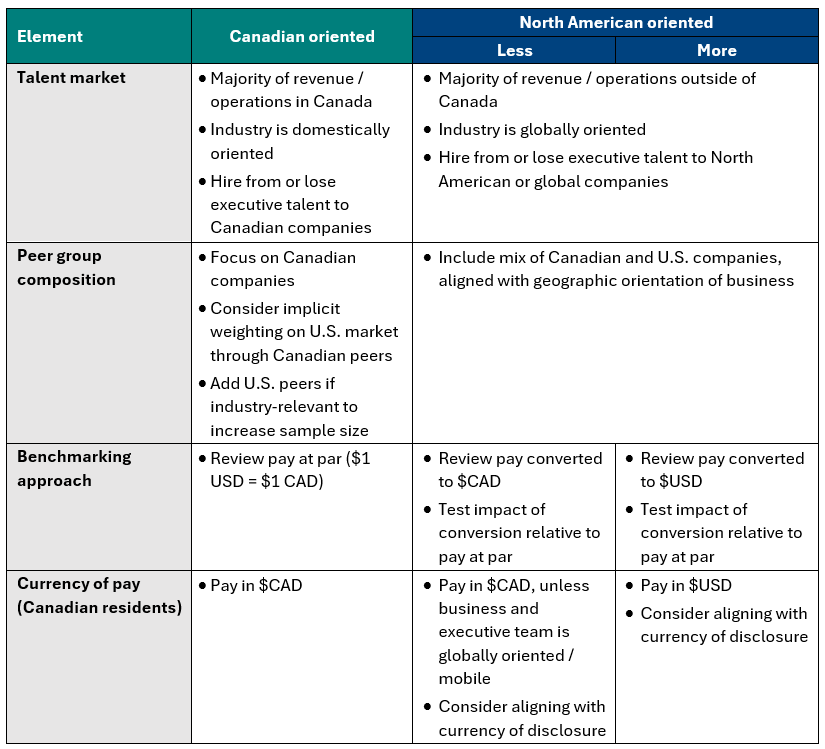

Below we provide a framework to navigate the currency decision as part of executive compensation benchmarking and pay calibration. Large Canadian organizations on the right (i.e., those that are more North American oriented) have increased rationale to calibrate and administer pay in $USD.

Talent Market

A Canadian company with the majority of its revenue and operations outside of Canada and operating in a globally oriented industry is more likely to hire from and compete with North American or global organizations for senior executive talent.

To test the concept of the North American talent market, we reviewed all NEO hires and departures among the TSX60 over the past three years. There are minimal instances of hiring from or attrition to the U.S. or internationally. Most examples of U.S. executive hiring are to lead U.S. or international divisions of a Canadian company. Rates of attrition to U.S. companies are similarly low. For large Canadian companies, core services roles (e.g. HR, legal, finance) generally have a Canadian talent market, whereas it may be appropriate to source North American / global talent for the CEO or select operating roles.

Peer Group Composition

Canadian companies may include U.S. peers in their executive compensation peer group because they have a North American talent market, or because there are limited Canadian comparators of a similar size or scope in a particular industry, necessitating the inclusion of U.S. companies as a proxy for a Canadian comparator. There are challenges with incorporating U.S. companies in the peer group (as shown by higher U.S. pay levels) given that ISS will only include Canadian companies in their pay for performance analyses which can highlight a relative pay disconnect if pay is calibrated against higher U.S. levels.

Regardless of the reason for using U.S. peers, prevalence is high. As presented in Figure 3, the average peer group composition in the TSX60 is 50% Canadian, 43% U.S. and 7% other countries, with only 13% of constituents using an-all Canadian peer group. This reflects the influence of “first degree” peer companies. When considering the impact of the comparator groups used by peers (“second degree” peers of peers analysis), U.S. influence increases to 62% for the full TSX60 and 38% for TSX constituents with fully Canadian peer groups.

Benchmarking Approach (At Par v. Converted Dollars)

When U.S. peers are used in benchmarking executive compensation, Canadian companies must determine whether to review pay at par or in converted dollars.

For roles or executive teams with a North American talent market, it is justifiable to review pay levels for the North American comparator group in converted dollars as incumbents could reasonably be hired by U.S. peers and earn the reported U.S. compensation in $USD. Compensation levels are then typically denominated in the currency of an executive’s residence (e.g., $CAD if living in Canada).

Another reason U.S. companies may be included in the executive compensation comparator group is to provide a proxy for limited Canadian companies of a similar industry / size / scope. To establish a robust sample size of 12 – 15 companies, Canadian organizations may need to look to the U.S. for companies with comparable characteristics. In this case, we recommend reviewing executive pay levels at par as the U.S. pay data is being used in lieu of available Canadian market data. A hybrid approach is to look at the market data both at par and in converted dollars. This will help demonstrate the impact of currency and present a range of market data to inform compensation decisions.

Currency of Pay

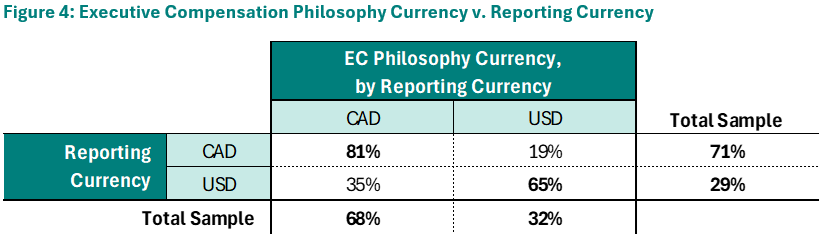

Large Canadian organizations that are primarily Canadian oriented in terms of revenue generation, business operations, and executive talent market are likely to report their financials in $CAD, while those with a North American focus often use $USD. Under Canadian disclosure rules, companies must report amounts in Canadian dollars or in the same currency that the company uses for its financial statements. As shown in Figure 4, among the full TSX60, majority practice is to disclose in $CAD, with 68% of constituents also setting and delivering pay in $CAD. Of the 29% of TSX60 companies that disclose their financial figures and pay levels in $USD, the proportion of companies setting pay in $USD increases to 65%.

Canadian companies who calibrate and deliver pay in $USD but disclose in $CAD should be cautious as the conversion to $CAD could cause disclosed pay levels to appear inflated. The influence of the exchange rate can also create unwanted and misleading fluctuations in disclosed pay levels year-to-year.

Canadian companies choosing to set and deliver executive pay in $USD should be aware that regardless of each company’s currency of financial reporting or peer group construction, proxy advisors ISS and Glass Lewis will convert compensation to $CAD in their review of pay-for-performance alignment. This conversion may introduce variability as the exchange rate changes – in particular, when the U.S. dollar is strong, higher disclosed $CAD pay levels may invite increased shareholder scrutiny, impacting Say on Pay support.

About The Authors

Caroline Marshall, Consultant & Vanessa Leung, Analyst

Prior to joining Southlea Group, she worked as an Associate at a large, global multi-service consulting firm, providing analytical support on executive and broad-based compensation projects.

She has experience supporting companies with a variety of compensation-related initiatives, including total rewards philosophy and peer group development, competitive benchmarking of board, executive, and broad-based pay, short- and long-term incentive plan design, and governance of compensation programs.

Caroline has experience working across many sectors, including financial services and Canadian pension plans.

Caroline has an Honours Business Administration degree from Wilfrid Laurier University and an Honours Mathematics degree from the University of Waterloo.

Prior to joining Southlea Group, she interned at the world’s largest cosmetics company, developing a brand campaign launch for the fastest-growing professional skincare brand in the United States.

Vanessa has experience working across several sectors including mining, oil & gas, manufacturing and technology.

Vanessa graduated with an Honours Business Administration with distinction from Ivey Business School at The University of Western Ontario. During her time at Ivey Business School, she took part in an exchange program at the National University of Singapore.